Evaluating data augmentation for financial time series classification

Elizabeth Fons1

Paula Dawson2

Xiao-jun Zeng1

John Keane1

Alexandros Iosifidis3

-

1Department of Computer Science, University of Manchester, UK.

2AllianceBernstein, London, UK.

3Department of Electrical and Computer Engineering, Aarhus University, Denmark.

Abstract

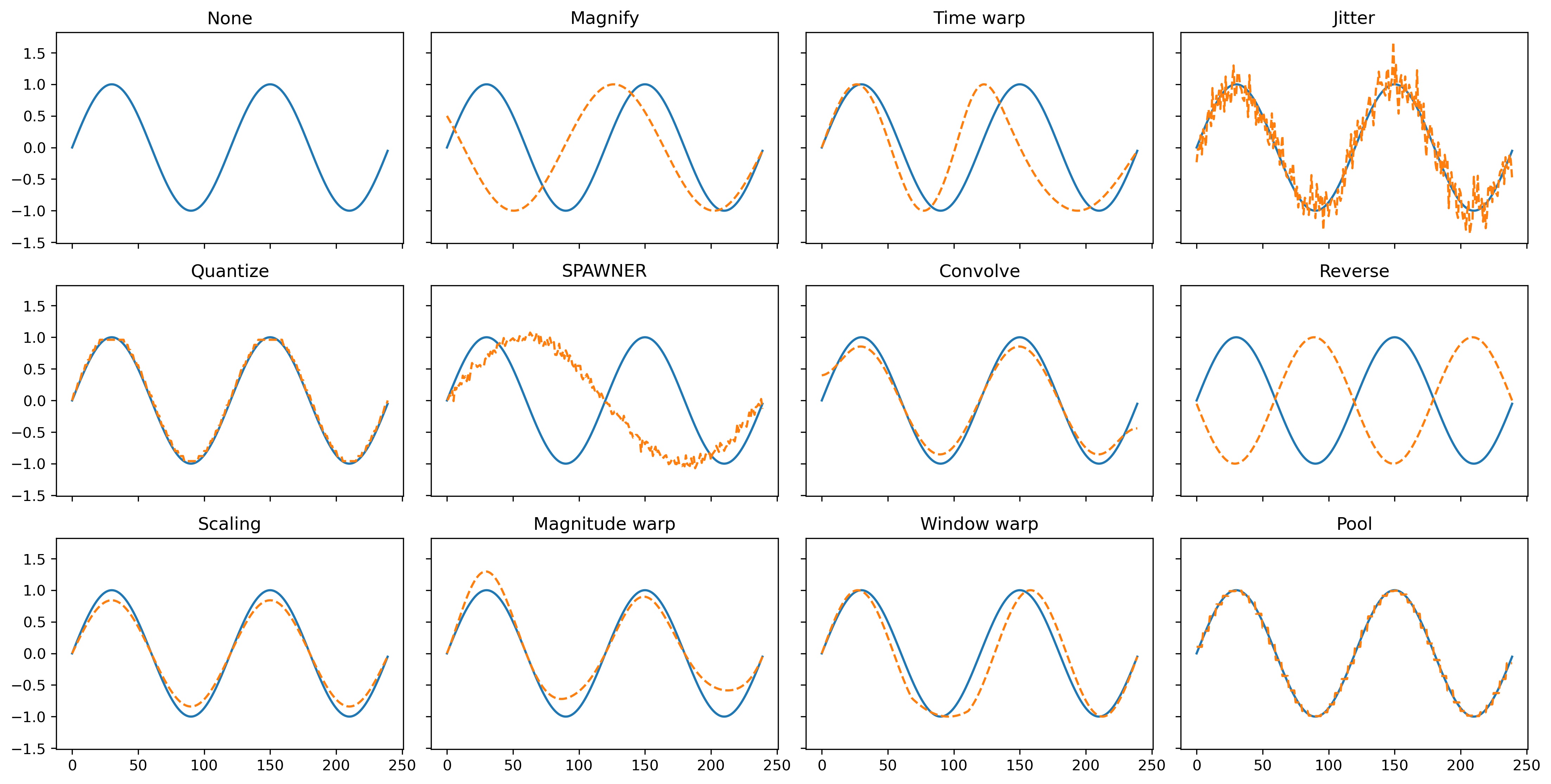

Data augmentation methods in combination with deep neural networks have been used extensively in computer vision on classification tasks, achieving great success; however, their use in time series classification is still at an early stage. This is even more so in the field of financial prediction, where data tends to be small, noisy and non-stationary. In this paper we evaluate several augmentation methods applied to stocks datasets using two state-of-the-art deep learning models.

The results show that several augmentation methods significantly improve financial performance when used in combination with a trading strategy. For a relatively small dataset (

Paper

Bibtex

x

@misc{fons2020-da-finance,title={Evaluating data augmentation for financial time series classification}, author={Elizabeth Fons and Paula Dawson and Xiao-jun Zeng and John Keane and Alexandros Iosifidis},year={2020},eprint={2010.15111},archivePrefix={arXiv},primaryClass={q-fin.ST}}

Acknowledgement

This work was supported by the European Union's Horizon 2020 research and innovation programme under the Marie Sklodowska-Curie Grant Agreement no. 675044 (http://bigdatafinance.eu/), Training for Big Data in Financial Research and Risk Management. A. Iosifidis acknowledges funding from the Independent Research Fund Denmark project DISPA (Project Number: 9041-00004).